Medical Coding and Billing Denials

Guidelines for Medical Coding and Billing Denials

Medical coding and billing denials are a common challenge in healthcare revenue cycle management. These denials can occur for various reasons, such as incorrect codes, lack of medical necessity, or incomplete documentation. Understanding how to handle and prevent denials is essential for reducing claim rejections, ensuring proper reimbursement, and maintaining a smooth billing process. Below are the key guidelines and strategies for coding and billing denials, including causes, best practices for prevention, and the process for appealing denied claims.

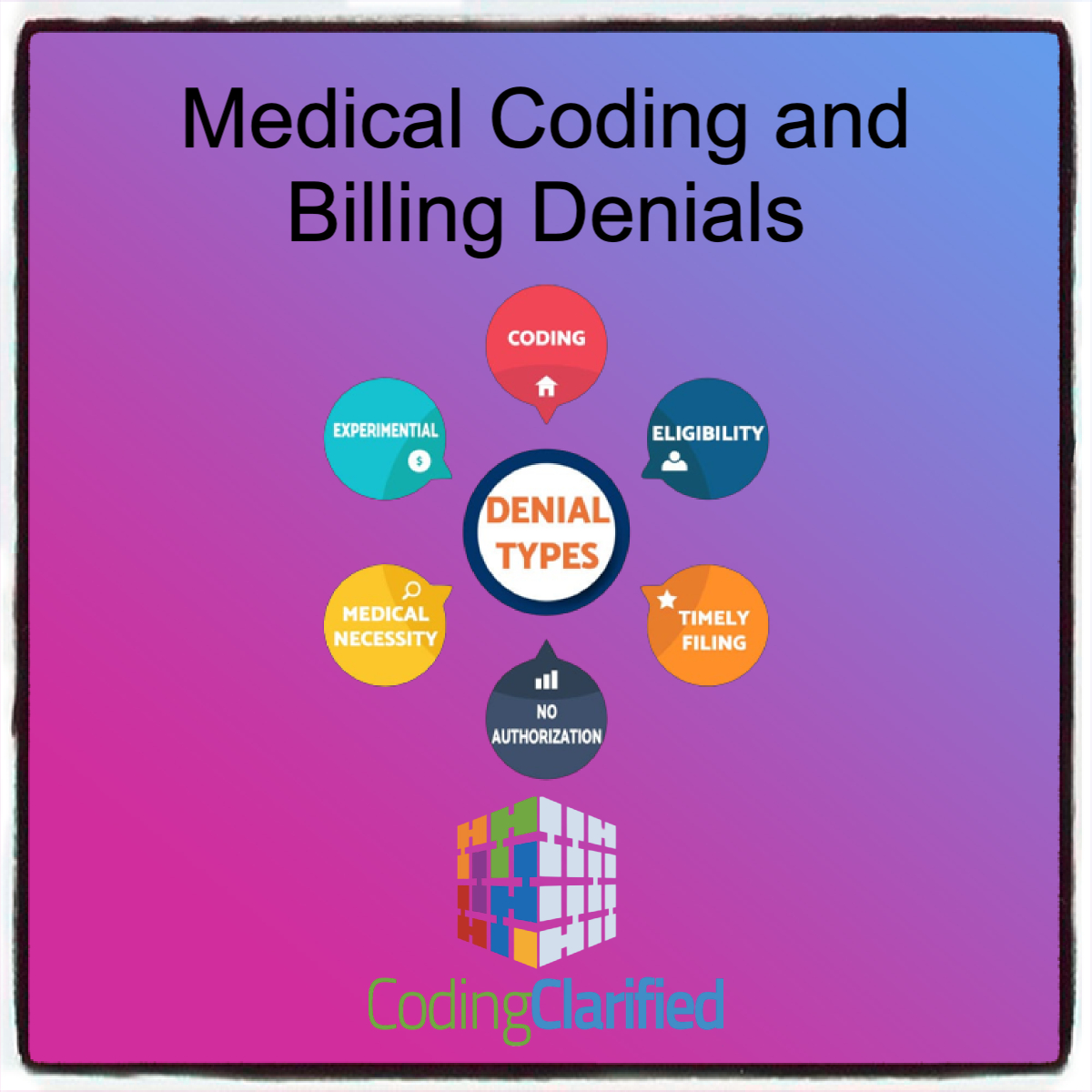

Understanding the Common Reasons for Denials

Before you can effectively prevent or appeal medical coding and billing denials, it’s crucial to understand the most common causes. These include:

Incorrect or Missing Codes

- CPT/HCPCS/ICD-10 errors: Incorrect use of codes or omission of codes can result in denials. For example, using the wrong CPT code for a procedure or missing a modifier can lead to claims being rejected.

- Upcoding or Downcoding: Upcoding (billing for more expensive services than provided) or downcoding (underreporting services) can result in denials or audits.

Lack of Medical Necessity

- Failure to demonstrate medical necessity: Insurance carriers often deny claims if the documentation does not support the necessity of the service or procedure.

- Inadequate clinical information: If the physician’s notes or reports do not justify the procedure, it can lead to a denial.

Timely Filing Issues

- Late submission: Most insurance providers have strict time limits for submitting claims. Late submissions often lead to denials.

Improper Use of Modifiers

Incomplete or Inadequate Documentation

- Missing information: Failure to submit the correct supporting documentation, such as pre-authorizations, test results, or physician notes, can result in claim denials.

Eligibility Issues

- Incorrect patient details: Incorrect or outdated insurance information, including errors in patient demographics (e.g., name, insurance ID, plan details), can cause denials.

Best Practices for Preventing Denials

Preventing denials starts with accurate coding and billing practices. Here are some key strategies to minimize the risk of denials:

Ensure Accurate and Complete Coding

- Verify Codes Before Submission: Double-check that all diagnosis (ICD-10) and procedure codes (CPT/HCPCS) are accurate and match the patient’s medical condition.

- Use the Right Modifiers: Ensure that the correct modifiers (e.g., Modifier 59, Modifier 22, Modifier 51) are applied appropriately based on the situation.

- Avoid Upcoding/Downcoding: Use codes that accurately reflect the services provided to avoid audit risk and denials.

Document Medical Necessity

- Thorough Documentation: Ensure that the patient’s medical records clearly justify the necessity of each service. The documentation should include symptoms, diagnoses, treatments, and why the service was needed.

- Linking Diagnosis and Procedure: Always link the correct ICD-10 code to the procedure in the CPT code. The diagnosis should justify the procedure being performed.

Timely Claim Submission

- Track Filing Deadlines: Ensure that claims are submitted within the allowed timeframe for each payer (e.g., 30 days, 60 days, or 90 days, depending on the insurer’s policy).

- Use Electronic Health Records (EHRs): EHRs can help ensure timely submission and reduce human error.

Pre-Authorization and Pre-Certification

- Obtain Pre-Authorizations: Some procedures require pre-authorization from the insurance company. Ensure pre-authorizations are obtained and documented before providing services.

- Pre-Certify High-Cost Services: Certain high-cost or elective services (e.g., surgeries, imaging studies) may require pre-certification. Failing to obtain this can result in denials.

Verify Patient Eligibility

- Insurance Verification: Verify patient eligibility before services are rendered, checking details such as plan type, coverage, deductibles, and copays. This helps avoid issues with out-of-network services.

- Check Coverage for Specific Services: Confirm whether the patient’s plan covers specific services (e.g., new technologies or experimental treatments).

Strategies for Handling Medical Coding and Billing Denial Claims

Despite your best efforts, some claims will inevitably be denied. When this happens, knowing how to effectively address the denial is critical to getting claims paid.

Review the Denial Letter

- Understand the Reason: The first step is to carefully review the denial explanation provided by the insurer. The letter should specify the reason for the denial (e.g., incorrect code, missing documentation, or lack of medical necessity).

- Assess the Validity: Determine whether the denial is valid or if there was an error in the claim. Sometimes denials are made in error due to system issues or simple mistakes.

Appeal Denied Claims

- File an Appeal: If the denial is deemed incorrect, you have the option to appeal. Ensure that the appeal is well-supported with all required documentation, such as:

- A copy of the original claim

- Medical records supporting the medical necessity of the service

- Any relevant test results or physician notes

- Timely Appeal: Most payers allow a window of time to appeal a denial (e.g., 30 to 90 days). Ensure that your appeal is submitted within this timeframe.

Resubmitting Corrected Claims

- Correct Errors: If the claim was denied due to coding errors or missing information, correct the errors and resubmit the claim. Common fixes include adding modifiers, updating the diagnosis code, or correcting patient details.

- Use Resubmission Codes: Some insurance carriers require the use of specific resubmission codes when re-submitting corrected claims.

Provide Additional Documentation

- Support Medical Necessity: If the claim was denied due to a lack of medical necessity, provide additional supporting documentation, such as updated physician notes, test results, or letters of medical necessity.

- Utilize Peer-to-Peer Reviews: In some cases, payers offer a peer-to-peer review process where a physician can speak directly with an insurance medical reviewer to explain the medical necessity of a procedure or service.

Tracking Denials and Identifying Trends

Consistently tracking and analyzing denied claims can help identify patterns and areas for improvement in your coding and billing practices.

Monitor Denial Rates

- Regularly track your denial rate to determine if the rate is increasing. A high denial rate may indicate issues with coding, documentation, or insurance verification practices.

Identify Root Causes

- Analyze denied claims to identify common reasons for denials (e.g., coding errors, lack of medical necessity, eligibility issues). Address these root causes by updating your processes, educating your staff, and making improvements.

Improve Staff Training

- Ongoing Education: Continuously educate your coding and billing staff on the latest coding guidelines, payer policies, and documentation requirements. Training staff on how to avoid common errors can reduce the likelihood of denials.

Appealing Denied Claims: The Process

- Review the Denial: Understand why the claim was denied by reviewing the Explanation of Benefits (EOB) or Remittance Advice (RA).

- Correct Any Errors: Fix any coding errors, incorrect patient information, or documentation omissions.

- Prepare the Appeal: Gather all relevant supporting documentation, such as medical records, letters of medical necessity, or peer reviews.

- Submit the Appeal: Follow the insurance carrier’s guidelines for submitting appeals, including the required timeframe and method (e.g., online portal, fax, or mail).

- Monitor the Appeal Status: Track the status of the appeal to ensure timely resolution and follow up if necessary.

- Escalate if Needed: If the appeal is unsuccessful, consider escalating the issue to higher levels within the payer organization or seek assistance from a third-party appeals expert.

Proper coding and billing practices are critical to reducing denials and ensuring that providers are reimbursed for their services. By understanding the common causes of denials, implementing best practices for coding and documentation, and developing a clear process for handling denied claims, healthcare providers can improve their revenue cycle management and minimize the financial impact of denials.

Common Medical Coding and Billing Denials and Adjustment Reasons You Need to Know

Claim denials fall into three categories: administrative, clinical, and policy—a majority of claim denials are due to administrative errors. Once you correct the errors, you can resubmit the claim to the insurance payer.

For example, the diagnosis and procedure codes may be incorrect, or the patient identifier and/or provider identifier (NPI) is missing or incorrect. Let’s examine a few common claim denial codes, reasons and actions.

CO-4: The procedure code is inconsistent with the modifier used or the required modifier is missing for adjudication (the decision process). Use the appropriate modifier for that procedure. For example, some lab codes require the QW modifier.

CO-15: Payment adjusted because the submitted authorization number is missing, invalid, or does not apply to the billed services or provider. Resubmit the claim with the authorization number or valid authorization.

CO-50: Non-covered services that are not deemed a “medical necessity” by the payer. To avoid coding denials, when you use a CPT® code, you must also demonstrate that it is “reasonable and necessary” to diagnose or treat the patient’s medical condition. Medical necessity is based on “evidence-based clinical standards of care.” Check the diagnosis codes or bill to the patient.

CO-97: The payment was adjusted because the benefit for this service is included in the payment/allowance for another service/procedure that has already been adjudicated. Resubmit the claim with the appropriate modifier or accept the adjustment.

CO-167: The diagnosis (es) is (are) not covered. Review the diagnosis codes(s) to determine if another code(s) should have been used instead. Correct the diagnosis code(s) or bill the patient.

CO-222: Exceeds the contracted maximum number of hours, days and units allowed by the provider for this period.

CO-236: This procedure or procedure/modifier combination is not compatible with another procedure or procedure/modifier combination that was provided on the same day according to the National Correct Coding Initiative (NCCI) or workers compensation state regulations/fee schedule requirements. The service has been paid as part of another service you billed on the same date of service.

CO-B16: The payment was adjusted because “New Patient” qualifications were not met. Resubmit the claim(s) with the established patient visit.

OA-109: Claim not covered by this payer/contractor. You must send the claim to the correct payer/contractor. Review coverage and resubmit the claim to the appropriate carrier.

PI-204: This service/equipment/drug is not covered under the patient’s current benefit plan. Bill the patient.

PR-1: Deductible amount. Bill to secondary insurance or bill the patient.

Currently, review reason codes and statements are available for the following services/programs: