Understanding Medicare Exam Guidelines for Medical Coding

Navigating Medicare exam guidelines is crucial for accurate medical coding and billing. This blog provides an overview of the key components of Medicare exam guidelines that coders must understand to ensure compliance and optimize reimbursements.

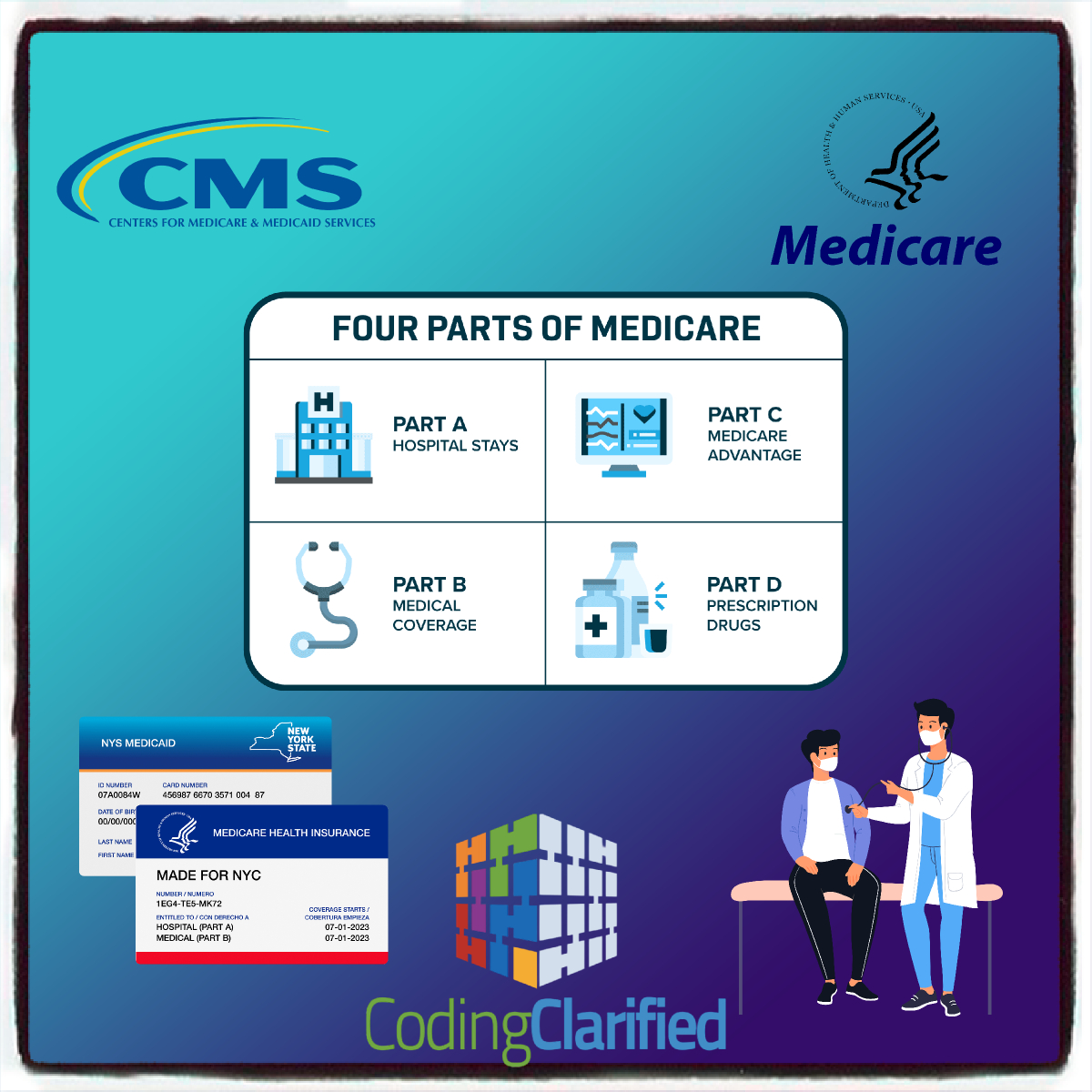

What is Medicare?

Medicare is a federal health insurance program primarily for individuals aged 65 and older, as well as certain younger individuals with disabilities. The program covers a range of medical services, but proper coding is essential to ensure providers are reimbursed for these services.

Key Components of Medicare Exam Guidelines

-

Understanding the Different Parts of Medicare

- Medicare Part A: Covers inpatient hospital stays, skilled nursing facility care, hospice, and some home health care.

- Medicare Part B: Covers outpatient care, preventive services, and some home health care. Most coding for examinations falls under Part B.

- Medicare Advantage Plans (Part C): Private plans that provide Medicare benefits, often including additional services.

- Medicare Part D: Provides prescription drug coverage, which has its own set of guidelines.

-

Coverage of Services

Medicare covers a range of services, but not all services are covered under all circumstances. Understanding which services are covered is essential for correct coding. Key areas to note include:

- Preventive Services: Annual wellness visits, screenings, and vaccinations often have specific coding requirements.

- Diagnostic Services: These may require documentation to justify medical necessity.

- Therapeutic Services: Must align with Medicare’s guidelines for coverage and coding.

-

Documentation Requirements

Proper documentation is critical for Medicare compliance. Key documentation guidelines include:

- Medical Necessity: Services must be medically necessary for coverage. Coders should ensure that the documentation supports the service provided.

- Detailed Records: Notes must be clear, complete, and concise. Include relevant history, findings, and treatment plans.

- Coding for Multiple Conditions: When multiple diagnoses are present, ensure that coding reflects the complexity of the patient’s conditions.

-

Use of CPT and ICD-10 Codes

Correctly coding services involves using the appropriate Current Procedural Terminology (CPT) codes and International Classification of Diseases (ICD-10) codes:

- CPT Codes: Used for reporting services and procedures provided to patients.

- ICD-10 Codes: Used for reporting diagnoses. Ensure the codes are specific and reflect the patient’s condition accurately.

-

Modifiers

Modifiers provide additional information about the service provided and can affect reimbursement. Common Medicare modifiers include:

- -25: Significant, separately identifiable E/M service on the same day.

- -59: Distinct procedural service.

- -76: Repeat procedure by the same physician.

Understanding when and how to use these modifiers can enhance the accuracy of claims. https://codingclarified.com/cpt-medical-modifiers/

-

Billing Guidelines

Familiarize yourself with billing guidelines specific to Medicare, including:

- Claim Submission: Ensure claims are submitted in a timely manner, adhering to deadlines.

- Appeals Process: Understand how to appeal denied claims effectively, including necessary documentation and timelines.

- Fee Schedules: Review the Medicare Physician Fee Schedule (MPFS) to understand reimbursement rates for services.

-

Compliance and Audits

Medicare is known for its stringent compliance requirements and audit processes. Coders should:

- Stay Informed: Regularly review updates to Medicare policies, coding guidelines, and documentation requirements.

- Conduct Internal Audits: Periodically assess coding practices to ensure adherence to Medicare guidelines.

- Training: Engage in continuous education to stay updated on changes in regulations and coding practices.

Understanding Medicare exam guidelines is essential for medical coders to ensure compliance and optimize reimbursements. By familiarizing yourself with coverage policies, documentation requirements, and coding practices, you can enhance the accuracy of your work and contribute to the financial health of healthcare organizations. Staying informed and proactive in your coding practices will lead to better outcomes for providers and patients alike.

Medicare Exams

Initial Preventive Physical Exam (IPPE)

Review of medical and social health history and preventive services education

Covered only once within 12 months of first Part B enrollment

Patient pays nothing (if provider accepts assignment)

Annual Wellness Visit (AWV)

Visit to develop or update a Personalized Prevention Plan (PPP) and perform a Health Risk Assessment (HRA)

Covered once every 12 months

The patient pays nothing (if provider accepts assignment)

Routine Physical Exam

Exam performed without relationship to treatment or diagnosis for a specific illness, symptom, complaint, or injury

Not covered by Medicare; prohibited by statute, however, the IPPE, AWV, or other Medicare benefits cover some elements of a routine physical

Patient pays 100% out-of-pocket

The term “patient” refers to a Medicare beneficiary

Initial Preventive Physical Examination (IPPE)

The IPPE, known as the “Welcome to Medicare” preventive visit, promotes good health through disease prevention and detection. Medicare pays for 1 patient IPPE per lifetime not later than the first 12 months after the patient’s Medicare Part B benefits eligibility date.

IPPE Components IPPE Coding, Diagnosis, & Billing

IPPE

The IPPE, known as the “Welcome to Medicare” preventive visit, promotes good health through disease prevention and detection.

Medicare pays 1 patient IPPE per lifetime not later than the first 12 months after the patient’s Medicare Part B benefits eligibility date.

Medicare pays the IPPE costs if the provider accepts assignment.

AWV

Medicare covers an AWV that delivers Personalized Prevention Plan Services (PPPS) for patients who:

- Aren’t within 12 months after the patient’s first Medicare Part B benefits eligibility date

- Didn’t get an IPPE or AWV within the past 12 months

- Medicare pays the AWV costs if the provider accepts assignment and the deductible doesn’t apply

Routine Physical Exam

Exam performed without relationship to treatment or diagnosis for a specific illness, symptom, complaint, or injury

- Medicare doesn’t cover the routine physical; it’s prohibited by statute, but Medicare covers some elements of a routine physical under the IPPE, the AWV, or other Medicare benefits

- Patient pays 100% out-of-pocket

Resources

Quick Start Guide

The Annual Wellness Visits video helps health care professionals understand each of these exams and their purpose, and the requirements when submitting claims for them.